Introduction

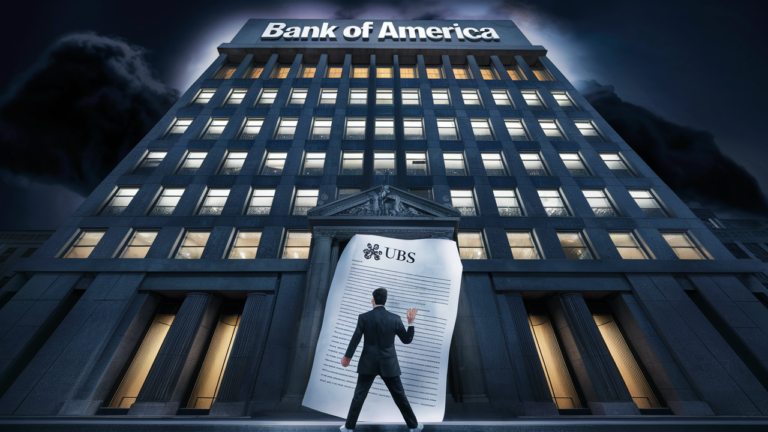

The banking sector is once again in the spotlight as Bank of America (BoA) faces a new lawsuit from UBS. The lawsuit, which has raised significant concerns in the financial industry, stems from allegations related to fraudulent practices, misleading investors, or possible regulatory violations. Given the size and influence of both financial giants, the case has the potential to reshape certain aspects of banking regulations and investor confidence.

Legal battles between major banks are not uncommon, but when two globally recognized institutions like UBS and Bank of America lock horns, it captures the attention of regulators, investors, and the general public. This lawsuit could have serious financial and reputational consequences for Bank of America, depending on the claims made by UBS and how the court proceedings unfold. In this article, we will explore the details of the lawsuit, the possible reasons behind it, the potential impact on both companies, and what it means for the broader financial market.

1. Background of the Lawsuit

To understand the significance of this lawsuit, it is important to explore the background of the dispute. While full details may still be emerging, UBS has reportedly filed the case due to alleged financial misconduct by Bank of America. This could involve issues related to securities fraud, breach of contract, or failure to comply with regulatory standards.

Over the past decade, financial institutions have been under increasing scrutiny from regulatory bodies such as the Securities and Exchange Commission (SEC) and the Federal Reserve. Any wrongdoing that violates financial laws or investor protection policies can lead to severe legal and financial repercussions. If UBS can substantiate its claims with strong evidence, Bank of America could face hefty fines, legal settlements, or even stricter regulatory oversight.

Additionally, the historical relationship between UBS and Bank of America may play a role in this dispute. The two institutions have been competitors and partners in various financial dealings. Any prior agreements, investments, or financial transactions between them may have contributed to the current legal battle.

2. Allegations Against Bank of America

While UBS has not yet disclosed all details of its claims, early reports suggest that the lawsuit involves accusations of financial mismanagement, misleading investors, or violating contractual agreements. If proven, these allegations could damage Bank of America’s reputation and raise concerns about its corporate governance.

Some of the possible allegations include:

- Fraudulent Misrepresentation: UBS may be accusing Bank of America of providing false or misleading information about certain financial products, transactions, or investments.

- Breach of Fiduciary Duty: If Bank of America was responsible for managing UBS’s assets or funds, the lawsuit could claim that the bank failed to act in UBS’s best interests.

- Regulatory Violations: The lawsuit may also involve claims that Bank of America failed to comply with regulatory requirements, potentially leading to investigations by government agencies.

Financial scandals in the past have shown that banks can face billions of dollars in legal settlements if they are found guilty of fraudulent activities. If these allegations hold, Bank of America may have to compensate UBS, and its credibility in the financial market could take a hit.

3. Potential Impact on Bank of America

Lawsuits of this magnitude can have significant repercussions on a financial institution’s operations. If the case gains traction, Bank of America could face various consequences, including financial penalties, reputational damage, and loss of investor trust.

Financial Penalties and Settlements

Legal disputes between major banks often result in hefty settlements. If the court rules in favor of UBS, Bank of America may be required to pay a substantial financial settlement, which could impact its quarterly earnings and financial stability.

Reputation and Investor Confidence

Reputation is crucial in the financial world. Investors, shareholders, and clients may lose confidence in Bank of America if the allegations gain widespread attention. A drop in stock prices, reduced business partnerships, and regulatory scrutiny could further impact the bank’s long-term growth.

Regulatory Scrutiny

Regulatory bodies such as the SEC and the Federal Reserve may closely monitor the lawsuit. If evidence suggests widespread misconduct, Bank of America could face stricter regulations, making it difficult for the bank to operate freely in certain markets.

4. How UBS Could Benefit from the Lawsuit

While lawsuits generally have a negative connotation, UBS may see some advantages in filing this case. Depending on the outcome, UBS could achieve the following benefits:

Legal Compensation

If UBS successfully proves its case, it could receive significant financial compensation from Bank of America, boosting its financial standing and mitigating any losses it incurred.

Market Positioning

Winning a lawsuit against a major competitor could strengthen UBS’s position in the financial market. It would signal to investors that UBS is taking legal measures to protect its interests and ensure fair financial practices.

Industry-Wide Impact

This lawsuit could set a precedent for future legal disputes in the banking industry. If Bank of America is found guilty, other banks may be more cautious in their financial dealings, leading to increased transparency in the industry.

5. Possible Outcomes of the Lawsuit

The legal process can be lengthy and complex, but there are a few potential outcomes for this case:

- Settlement Agreement: The most common outcome in corporate lawsuits is a financial settlement, where Bank of America may choose to pay UBS rather than go through a prolonged legal battle.

- Court Ruling in Favor of UBS: If UBS presents strong evidence, the court may rule against Bank of America, resulting in financial penalties and potential regulatory actions.

- Dismissal of the Case: If the lawsuit lacks substantial evidence, the court may dismiss the case, allowing Bank of America to avoid penalties.

- Regulatory Investigation: Regardless of the court’s decision, regulatory agencies may launch independent investigations to ensure compliance with financial laws.

FAQs

1. Why is UBS suing Bank of America?

UBS is suing Bank of America over allegations of financial misconduct, fraud, or breach of contract. The lawsuit aims to seek legal compensation and accountability.

2. How will this lawsuit affect Bank of America’s stock?

The stock price of Bank of America may experience fluctuations depending on investor reactions, media coverage, and legal developments. If the case gains traction, there could be a decline in stock value.

3. What are the possible penalties for Bank of America?

If found guilty, Bank of America could face financial penalties, legal settlements, regulatory scrutiny, and reputational damage.

4. How long will the lawsuit take to resolve?

Corporate lawsuits can take months or even years to resolve, depending on the legal proceedings, negotiations, and possible settlements.

5. Could this lawsuit impact other banks?

Yes. If the lawsuit exposes broader financial issues, it could lead to increased scrutiny and regulatory changes affecting other major banks.

Conclusion

The legal battle between UBS and Bank of America is a significant event in the financial industry. While the full details of the lawsuit are still emerging, the case could have serious financial and reputational consequences for Bank of America. Depending on the outcome, it could result in regulatory scrutiny, financial penalties, or increased transparency in banking practices.

For investors, financial analysts, and regulatory authorities, this lawsuit serves as a reminder of the importance of ethical financial practices. Regardless of the verdict, the case highlights the ongoing challenges within the banking sector and the need for stricter compliance with financial regulations.

As the legal proceedings unfold, the financial world will be watching closely to see how this dispute plays out and what it means for the future of both UBS and Bank of America.